Archive for Finance

August 12, 2011 at 7:23 am · Filed under Banks, Builder, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, Loans, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Residential Property, Selling ·Tagged buy, home loan, Indian Real Estate, lease agreement, property transfer, registration agreement, rent, residential property, sale deed, stamp duty, title deed

One always thinks that owning a home is the best option. But at times renting has an upper hand as it can economically help you and help you save on your cash. It is you who can see through the situation and then work out a plan that suits you and your pocket before you decide anything.

One always thinks that owning a home is the best option. But at times renting has an upper hand as it can economically help you and help you save on your cash. It is you who can see through the situation and then work out a plan that suits you and your pocket before you decide anything.

At one point or the other everyone in his or her life faces this question as to whether go for a rented accommodation or by his own dream home. Some people opt for the rented abodes while others prefer to invest their money in buying a home. This is a very crucial decision and one has to consider all aspects before making the final call as there is always a possibility of things going topsy-turvey and your dream of buying a home can become the biggest nightmare of your life which might end up with financial crunches.

Advantages of Renting

- Monthly rentals – as the monthly rental installments can be planned before hand so there is no place left for uncertainties, though there is a rise in the rental rates every year but this is also not unsure.

- Legal requirements of having a rent or a lease agreement in place are important. This agreement is normally for a year or 11 months depending on the applicable legislations. But this agreement can be annulled at landlord’s will during the said tenure; there is always an uncertainty over rental places.

- Cost of moving from one rented place to another one after the lease expires.

- Emotional cost of moving from one rented house to another along with the loss of accrued property.

- Opportunity cost required in the case of rented homes is the price appreciation

- No threat engaged in the form of any changes in the real estate sector.

- Tax benefits can be availed by staying in the rented accommodation as many employers have to pay House rent allowance to the employees staying at rented houses. However, this normally offsets the tax benefit as it is counted for the interest paid out on home loan, though it may vary from one situation to another.

Advantages of Buying

Advantages of Buying

- Amount involved in buying an own home can be computed and can be paid as per the expediency-no uncertainty involved if the buyers goes for the construction linked plan.

- Legal requirements include in case of new property are title deed, sale deed, stamp duty and registration agreement, in case of resale property transfer deed is also required.

- Expenses have to be borne for maintenance, utilities, renovations and other such issues including the property tax as well.

- Emotional gain as being capable enough to accumulate and contribute towards the property accrued.

- Opportunity cost incurred is in the form of cost of capital.

- Risk involved is that the real estate sector is always accompanied with a huge amount uncertainty which eventually effects that the final price appreciation of the home bought. There is also a financial risk involved with the rise of the interest rates of home loan in case if taken.

- Tax benefit evaluation needs to be calculated as this might vary in different situations.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

August 12, 2011 at 7:15 am · Filed under Builder, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, Loans, Marketing, Properties, Prospecting, Real esate, Real estate trends, Residential Property, Selling ·Tagged banks, emi, financial institution, home loan, Indian Properties, Interest Rates, real estate India, residential property

Interest rates for home loans have experienced a dramatic rise since last year, escalating the EMIs on home loans, specifically for home buyers who choose floating interest rates. As expected, most of them are taken aback by the effect increasing interest rates on their monthly expenditure. Furthermore, many financial institutions are thinking to further toughening the home loan interest rates in the coming months.

Interest rates for home loans have experienced a dramatic rise since last year, escalating the EMIs on home loans, specifically for home buyers who choose floating interest rates. As expected, most of them are taken aback by the effect increasing interest rates on their monthly expenditure. Furthermore, many financial institutions are thinking to further toughening the home loan interest rates in the coming months.

Financial connoisseurs always advise that the home loan seekers should always keep their EMIs within manageable limits. This means that if you are going for a bigger home loan amount then you can pre-pay the loan, bargain with the bank to offer you better interest rates or even try and stretch the loan duration so that you can maintain your monthly expenses.

CHANGE THE FINANCIAL INSTITUTION

You can opt for home loan refinancing or balance transfer by changing to another financial institution or bank in order to get a better deal. Home loan seekers normally have complains about the banks being unfair to them as they raise the floating home loan interest rates in the tough interest rate situation, but are not keen to reduce the interest rates when the rates have toned down. However, many loan seekers are not interested in changing their financial institution or the lender.

The home loan borrowers who have taken loans before June 2008 have seen interest rates rising to 12-13%. “Many borrowers who have taken loans prior to June 2008 would have seen their rates touch 12%-13% now. These borrowers should specially go for the option of changing their financial lending vendor.

The financial institutions are also keen to take over the existing home loans by proposing a lower interest rate to lure borrowers. Although the balance transfer will surely decrease your EMI installments but there is no one-size-fits-all key for everyone. To understand whether changing the lender will help you out or not you need to analyze the complete situation and calculate the exact benefits that you will derive from it before deciding anything.

DO THE BASIC WORK

First step in this process is to do a research on home loan interest rates applied by other financial institutions or banks. The rates are available on the web portals of all financial institutions or banks. This research work will actually help you out in getting the best deal, i.e., you can get a better picture about the bank that is willing to charge a significantly lesser interest rate after taking over your home loan.

Transferring the balance can only be beneficial for you if the interest rate difference is at least 1.75 to 2.00% points.

Though, a home loan is a long duration debt, so even half-a-percentage point would make a lot of difference in the long run. For that reason, the duration left for the original loan will play an important part in deciding whether to change the financial institution or not. The bigger the loan tenure is remaining, the more will be your total savings. If you just have 3-4 years left to repay your loan then changing the lender will not make any difference for you but if the remaining tenure is around 13-14 years then switching the financial institution will be helpful in the long run.

CHARGES AND FINES

You also need to consider the pre-payment fee that is payable in name of the existing financial institution.

Most of the financial institutions do away with this fee if the prepayment is made by the borrower’s own account. Hence, you will be charged with a penalty in case of balance transfer for the existing home loan.

Normally, most of the financial institutions or banks levy around 2% of the remaining home loan amount as pre-payment penalty. This can turn out to be a considerable amount especially when the remaining home loan amount is sizeable. It could turn out to be a significant amount, particularly if the outstanding balance is huge. Though it is a one-time payment, but you need to check the impact it will be making on your total savings in order to calculate the actual benefit attained.

Though, many home loan seekers are not aware that the financial institution or the bank which is taking over the loan also finances the prepayment penalty cost. So the fear of paying a huge amount as the penalty should not restrain you from going for a balance transfer.

Along with this you also need to take into account the processing fees that the new vendor will be charging you for refinancing the home loan. Most financial institutions or banks levy 0.5% of the total home loan amount as processing fee.

COST-BENEFIT EVALUATION

COST-BENEFIT EVALUATION

If you have decided to change your home loan vendor then the first thing you need to do is to evaluate your total savings during the complete duration of the home loan period. In simple words, you need to calculate savings on interest expenditure subtracting processing fee that you need to pay to the new opted financial institution along with the prepayment penalty.

THE PROCESS

The process to change the financial institution or the bank is moderately easy. The home loan seeker needs to comply with the norms laid by the new bank for credit-worthiness and repayment capacity.

Once you meet the conditions laid down by the new bank, the property-related papers will be handed over to the new lending financial institution by the old one prior to the outstanding payment is made in the name of the latter.

The borrower’s role in the transfer process is limited but you should all the loan and property-related documents in place. If in case, the previous financial institution fails to give some original documents to the new bank then you should always have photocopies of the same available with you.

Hence if at any point of time you feel that you are wedged with your current home loan provider in spite of economical options existing in the market, then you can surely consider the option of switching over the financial institution or the bank.

Calculate all the fees and penalties, bargain with other financial institutions and you can lucratively cut down your EMI installments regardless of the increasing home loan interest rate situation.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

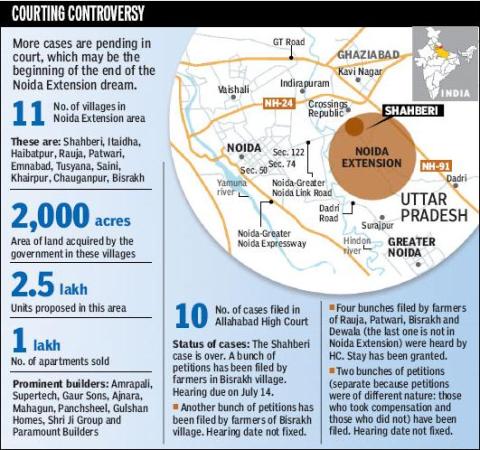

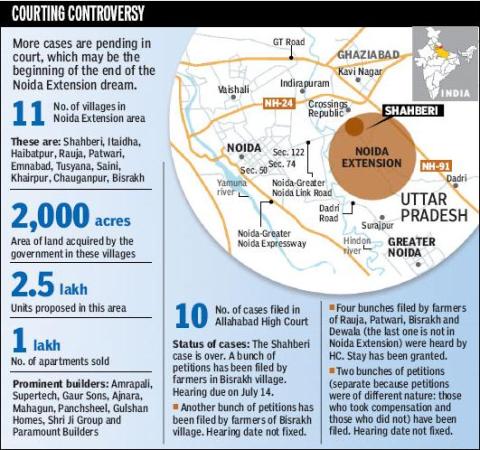

July 20, 2011 at 10:25 am · Filed under Builder, Commercial Property, Delhi, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, lawyer, legal, Loans, Marketing, NCR Region, Pre-owned homes, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Residential Property, Selling ·Tagged Ajnara, Allahabad High Court, Greater Noida Industrial Authority, indian property, Indian Real Estate, Land Acquisition Act, Noida Extension, Patwari Village, residential property, Shahbheri Village, Spring Medows Panchsheel – Hinish Stellar- Jeevan Project Earth Group - Towne Paramount - Emotions, Supertech Eco Village Nirala - Nirala Estate Patel Group - Neo Town Arihant - Arden Arihant Eros group – Sampurnam Amrapali - Leisure Park, Supreme Court

On 19th July 2011 another verdict was given by the Allahabad High Court that scraped another land acquisition in Noida Extension by the Greater Noida Industrial Authority. 589 hectares of land was acquired by the Authority in Patwari village, in Noida Extension, by bringing into play the urgency clause. The land was purchased for the industrial development in the region but it was given away to real estate developers for numerous residential and commercial projects.

On 19th July 2011 another verdict was given by the Allahabad High Court that scraped another land acquisition in Noida Extension by the Greater Noida Industrial Authority. 589 hectares of land was acquired by the Authority in Patwari village, in Noida Extension, by bringing into play the urgency clause. The land was purchased for the industrial development in the region but it was given away to real estate developers for numerous residential and commercial projects.

This decision of the Allahabad High Court came after a fortnight following the Supreme Court’s order which defended the high court’s order regarding cancellation of land acquisition of more than 150 hectares in Shahberi village.

A division bench comprising of Justices Sunil Ambawani and S S Tiwari scraped the land acquisition stating that ther was no need to bring up the urgency clause. The court gave the verdict on a group of petitions filed by the farmers from Patwari village.

According to Parminder Bhati, the farmers’ lawyer, this decision of the High Court will surely bring respite to at least 1,600 farmers from the region. He further added that this decision will adversely affect almost 18 big and small developers who have launched or own the land in the area.

The court rejected some of the affidavits that were presented before him by the government lawyer. These affidavits stated that villagers have no objection to the land acquisition and have been satisfactorily compensated. Bhati told that the court ignored all these affidavits.

He said that some of the farmers in Patwari village had accepted compensation but a large number of farmers had refused to the same.

The land acquisition process in Patwari Village was initiated on March 12, 2008. But in September 2009, the Greater Noida Industrial Authority brought into play the urgency clause under Section 17(1) of the Land Acquisition Act, 1894 — which offers for abstaining from the right of a tenure holder to a hearing on whether he wishes to sell off his land or not — and acquired possession of 589.13 hectares of land on papers. The farmers’ counsel said that the physical possession of the land had not started by that time.

In the coming few days, the court would be giving out verdicts about alike petitions which comprise of at least eight more villages from Noida Extension where developers have launched numerous housing projects.

On 20th July 2011, the villagers from Roja and Yakubpur villages are expecting to get another verdict from the high court on the petition filed by them, following which the petitions filled by the village residents from Bisrakh, Itehda, Haibatpur, Ghanola and Malcha would be decreed. On 26th July 2011, the petition filed by the villagers from Dewla is expected to be decided by the high court.

In Noida Extension, 12 projects from 11 builders are affected that include:

- Supertech Eco Village

- Nirala – Nirala Estate

- Patel Group – Neo Town

- Arihant – Arden Arihant

- Eros group – Sampurnam

- Amrapali – Leisure Park, Spring Medows

- Panchsheel – Hinish

- Stellar- Jeevan Project

- Earth Group – Towne

- Paramount – Emotions

- Ajnara

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

July 16, 2011 at 9:40 am · Filed under Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, Loans, Marketing, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Residential Property ·Tagged Allahabad Bank, Andhra Bank Limited, Axis Bank Limited, bank, Bank of Baroda, Bank of India, Canara Bank Limited, Corporation Bank, Dena Bank Limited, Dhanlaxmi Bank Limited, HDFC Bank Limited, home loan, ICICI Bank Limited, IDBI Bank Limited, Indian Bank, Indian Overseas Bank Limited, indian property, Indian Real Estate, IndusInd Bank Limited, ING Vysya Bank Limited, interest rate, Kotak Mahindra Bank Limited, Oriental Bank of Commerce, Punjab and Sind Bank, Punjab National Bank, residential property, State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of India, State Bank of Mysore, Union Bank of India

| Banks |

Rate of Interest |

| Allahabad Bank |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Andhra Bank Limited |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Axis Bank Limited |

Base Rate to 9.75% and Benchmark Prime Lending Rate to 17.50% |

| Bank of Baroda |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Bank of India |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Canara Bank Limited |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Corporation Bank |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Dena Bank Limited |

Base Rate to 10.20% and Floating Reference Rate to 15.25% |

| Dhanlaxmi Bank Limited |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 19.25% |

| HDFC Bank Limited |

Base Rate to 9.50% and Benchmark Prime Lending Rate to 18.00% |

| ICICI Bank Limited |

Base Rate to 9.50% and Floating Reference Rate to 15.25% |

| IDBI Bank Limited |

Base Rate to 10.00% and Benchmark Prime Lending Rate to 14.50% |

| Indian Bank |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Indian Overseas Bank Limited |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| IndusInd Bank Limited |

Base Rate to 10.00% and Benchmark Prime Lending Rate to 18.00% |

| ING Vysya Bank Limited |

Base Rate to 9.70% and Benchmark Prime Lending Rate to 18.25% |

| Kotak Mahindra Bank Limited |

Base Rate to 9.50% and Benchmark Prime Lending Rate to 18.25% |

| Oriental Bank of Commerce |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

| Punjab and Sind Bank |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.75% |

| Punjab National Bank |

Base Rate to 10.00% and Benchmark Prime Lending Rate to 13.50% |

| State Bank of Bikaner and Jaipur |

Base Rate to 9.75% and Benchmark Prime Lending Rate to 14.75% |

| State Bank of Hyderabad |

Base Rate to 10.00% and Benchmark Prime Lending Rate to 14.50% |

| State Bank of India |

Base Rate to 9.50% and Benchmark Prime Lending Rate to 14.25% |

| State Bank of Mysore |

Base Rate to 9.75% and Benchmark Prime Lending Rate to 14.50% |

| Union Bank of India |

Base Rate to 10.25% and Benchmark Prime Lending Rate to 14.50% |

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

July 15, 2011 at 4:57 am · Filed under Builder, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, legal, Loans, Marketing, NCR Region, Pre-owned homes, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Referal, Repatriation, Residential Property, Selling ·Tagged Ajnara, Allahabad High Court, Amrapali, Greater Noida Authority, Gulshan Builders, Indian Properties, Indian Real Estate, Land Acquisition Act, land use, Mahagun, Panchsheel, residential property, shahberi village, SJP Infracon, Supertech, Supreme Court

The morning of 6th July 2011 brought new ray of hope for the famers of Shahberi village as the Supreme Court defended the judgment for cancellation of huge area of land allotted by Greater Noida Authority (GNA) to real estate developers. This decision of the Court has shattered the dreams of the developers of earning huge revenues as they had launched or were planning to launch new projects in the area.

The morning of 6th July 2011 brought new ray of hope for the famers of Shahberi village as the Supreme Court defended the judgment for cancellation of huge area of land allotted by Greater Noida Authority (GNA) to real estate developers. This decision of the Court has shattered the dreams of the developers of earning huge revenues as they had launched or were planning to launch new projects in the area.

A bench including Justices G S Singhvi and A K Ganguly sternly condemns GNA for granting approval to developers for illegally changing the land use from industrial to residential purpose and enforced a cost of Rs 10 lakh on the same. The bench also stated that the money will be spent to help poor litigants to fight their cause in Supreme Court.

The Bench rejected the pleas raised by the developers and the Greater Noida Authority and further added that the judgment given by the Allahabad High Court regarding cancellation of the possession of agricultural land in Shahberi village was right. The HC in its order had said that it was misuse of executive power and the purpose behind it was to deceive people as result it was indefensible under the Land Acquisition Act.

The developers who have been asked to abandon their projects include Amrapali, Ajnara, Supertech, Mahagun, Panchsheel, SJP Infracon and Gulshan Builders. The Greater Noida Authority has allotted 4 lakh square meters of land to these builders.

The developers who have been asked to abandon their projects include Amrapali, Ajnara, Supertech, Mahagun, Panchsheel, SJP Infracon and Gulshan Builders. The Greater Noida Authority has allotted 4 lakh square meters of land to these builders.

What killed the case of Greater Noida Authority was the transfer of the land in Shahberi village to these developers ahead of the Uttar Pradesh Government’s approval to its request to alter the land use from industrial to residential purpose.

The U.P. Government had purchased the land in Shahberi village for industrial purpose to plan future developments in Greater Noida. Taking into consideration the Collector’s report which shows that 185 farmers, who are the original owners of the acquired land, would be left homeless due to this land acquisition by the GNA, the bench repetitively asked the Authority to be sympathetic and understand the grief of the peasants.

What annoyed the bench was the transfer of the acquired land to builders that is barefaced violation of Land Acquisition Act and expecting an adverse judgment from the Allahabad High Court. It also stated that the authorities have to act only in public interest only where as in the current scenario the Greater Noida Authority was serving private interest and deceiving the purpose of public interest.

The developers reasoned the ruling by stating that they had no trace regarding the transfer of acquired land in their name without obtaining clearance before the change of land use from industrial to residential and wanted to defend the interest of thousands of investors and customers who have already put in their money in these housing projects.

On this plea, the Supreme Court said that it was the developers who were behind the scene when the Greater Noida Authority transferred the acquired land for residential purposes without approval.

A great model of land aggregation where all the parties i.e the govt authorities, the developer, the farmers and the home seekers would have benefited went wrong due to the greed and mishandling of the government officials.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

June 29, 2011 at 4:55 pm · Filed under Bangalore, Builder, Commercial Property, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, legal, Loans, Pre-owned homes, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Referal, Repatriation, Residential Property, Selling ·Tagged Bannerghatta Road, Fraser Town, HSR Layout, indian property, information technology, Jayanagar, Koramangala, Malleswaram, Outer Ring Road (ORR), R T Nagar, Rajajinagar, residential property, Sadashivanagar, Sarjapur Road, Vasant Nagar, Vijayanagar, Whitefieldindian real estate

The Information Technology (IT) sector guided a major upheaval in the panorama of Bangalore. Development and conveniences were confined to certain parts of the city but the today the city has stretched out its arms and has started developing towards the suburbs and the peripheral areas. With commercial growth are on the horizons in the regions away from the main city, residential choices bounced in the area to meet the increasing demand. Market analysts elucidate this as the IT companies need commercial spaces with huge floor space to accommodate the large number of employees thus paving way for the growth of bigger office complexes specially designed to supply to their needs. These office spaces growth calls for huge piece of land and such land is available in the suburban and peripheral areas of the city. As majority of the IT companies are established in the outside peripheries, demand for residential alternatives heighten is the regions located near to these office developments. Few such new areas that are experiencing spurge in the residential and commercial growth are Koramangala, Bannerghatta Road, HSR Layout, Outer Ring Road (ORR), Sarjapur Road, and Whitefield. Growth of premium homes Conventionally, the major residential regions of Bangalore were by and large limited to Sadashivanagar, Vasant Nagar, R T Nagar, Malleswaram, Rajajinagar, Jayanagar, Vijayanagar, and Fraser Town amongst others. The residential alternatives available in these areas were typically standalone individual bungalows or houses and relatively very few apartment developments. Conversely, with the IT revolution, the city propelled as a foremost IT city in the country and the amiable climatic conditions and moderately affordable values experienced top IT organizations building their offices here. In addition to these commercial developments, an increased demand was brought about in the in the residential sector paving way for some of the major residential developments in the city across areas close to these office developments. Market analysts further added that the meaning of premium homes has witnessed a lot of changes in the precedent, and it will prolong to do so in agreement with modifications in the economy. For example, prior the premium apartments’ sizes vary from 1,600-1,800 sq ft in developing areas like Outer Ring Road and Whitefield, and villas were sized at 1,800-2,200 sq ft.

The Information Technology (IT) sector guided a major upheaval in the panorama of Bangalore. Development and conveniences were confined to certain parts of the city but the today the city has stretched out its arms and has started developing towards the suburbs and the peripheral areas. With commercial growth are on the horizons in the regions away from the main city, residential choices bounced in the area to meet the increasing demand. Market analysts elucidate this as the IT companies need commercial spaces with huge floor space to accommodate the large number of employees thus paving way for the growth of bigger office complexes specially designed to supply to their needs. These office spaces growth calls for huge piece of land and such land is available in the suburban and peripheral areas of the city. As majority of the IT companies are established in the outside peripheries, demand for residential alternatives heighten is the regions located near to these office developments. Few such new areas that are experiencing spurge in the residential and commercial growth are Koramangala, Bannerghatta Road, HSR Layout, Outer Ring Road (ORR), Sarjapur Road, and Whitefield. Growth of premium homes Conventionally, the major residential regions of Bangalore were by and large limited to Sadashivanagar, Vasant Nagar, R T Nagar, Malleswaram, Rajajinagar, Jayanagar, Vijayanagar, and Fraser Town amongst others. The residential alternatives available in these areas were typically standalone individual bungalows or houses and relatively very few apartment developments. Conversely, with the IT revolution, the city propelled as a foremost IT city in the country and the amiable climatic conditions and moderately affordable values experienced top IT organizations building their offices here. In addition to these commercial developments, an increased demand was brought about in the in the residential sector paving way for some of the major residential developments in the city across areas close to these office developments. Market analysts further added that the meaning of premium homes has witnessed a lot of changes in the precedent, and it will prolong to do so in agreement with modifications in the economy. For example, prior the premium apartments’ sizes vary from 1,600-1,800 sq ft in developing areas like Outer Ring Road and Whitefield, and villas were sized at 1,800-2,200 sq ft.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

June 28, 2011 at 4:44 pm · Filed under Builder, Commercial Property, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, legal, Loans, NRI Related, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Referal, Repatriation, Residential Property, Selling, US ·Tagged agricultural land, Bangalore, expatriates, FEMA, Foreign Exchange Management Act, high=end home, HNI, indian property, Indian Real Estate, lease, NRI, PIO, residential property

The Indian real estate scenario is experiencing an abrupt surge in the overall demand for high-end homes. Amid the exclusive aspects following this surge in demand is the increasing number of NRIs returning, first generation industrialists who are booming in their new set-ups, startup organizations and multinational companies employing emigrants for their growth in the country. Contrasting the previous scenarios, it is the buyers who are controlling the real estate sector now.

The Indian real estate scenario is experiencing an abrupt surge in the overall demand for high-end homes. Amid the exclusive aspects following this surge in demand is the increasing number of NRIs returning, first generation industrialists who are booming in their new set-ups, startup organizations and multinational companies employing emigrants for their growth in the country. Contrasting the previous scenarios, it is the buyers who are controlling the real estate sector now.

The demand mainly is around parts of the country where vast piece of land area is available thus making it promising for builders to provide an all-inclusive array of amenities that have not been heard about in any such housing project.

The demand from corporates for accommodation for emigrant employees has also called for the requirement for high-end homes constructed with international standards which these expatriate are used to. Apart from this, the corporates are also eager to pay lofty rentals for such properties to offer the precise ambience for such employees during their tenure in the country.

The boost in demand for such homes is majorly coming from the IT sector because of the improved connectivity levels and the accessibility of high-end homes in parts nearer to MNCs. In Bangalore, quite lot of villa projects are speeding up the construction process which are estimated to be around the price range of Rs 1.5 crores and a few more are coming up in proximity to Whitefield and Old Madras Road which is another indicator to the spurt in demand for high-end projects.

One of the biggest reasons behind this spurge is the keen interest of the investors who are keeping a tab on the rise in demand for high-end homes and the resulting rentals. Wherever enhanced connectivity options are visible and the vicinity is good enough, the demand keeps on increasing for such homes in the country.

One of the biggest reasons behind this spurge is the keen interest of the investors who are keeping a tab on the rise in demand for high-end homes and the resulting rentals. Wherever enhanced connectivity options are visible and the vicinity is good enough, the demand keeps on increasing for such homes in the country.

Developers who are developing high-end homes state that most of the queries they get are from businessmen, senior corporate executives and high net worth individuals. Some of them are even keen to invest in a second home. Expatriates are also interested in buying such homes but due strict documentation laws, they normally choose to go for a lease rather than out-and-out buy.

As per the ruling of the Foreign Exchange Management Act (FEMA), nationals of foreign origin who are residing in India can invest in only one residential property once they get sanctions agreed upon by the concern authorities like the State government.

Foreign diplomats can buy and sell any property other than agricultural land, plantation property and farmhouse in the country with aforementioned approval from the Government of India. The payment should be made only through foreign inward remittances by the means of normal banking channels.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

June 23, 2011 at 5:38 pm · Filed under Agent, Banks, Broker, Brokergae, Builder, Commercial Property, Delhi, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, Loans, Marketing, NCR Region, NRI Related, Prospecting, Real esate, Real estate trends, Reality Firms, Referal, Repatriation, Selling ·Tagged bandra kurla complex, central business district, commercial property, commercial space, connaught place, delhi, gurgaon, Indian Real Estate, natinal capital region, noida, office space

The present Indian economic scenario is finally showing a northward movement for the demand in the commercial real estate sector. Consecutively, the higher demand for the office space will also influence the sale in the residential real estate sector too. According to a market research, the first quarter of 2011 experienced a 20% increase (almost 6 million sq ft) in the demand for office market all over every potential real estate sectors in the country in comparison to the same duration last year. Almost around 27% of the total office space was absorbed in the National Capital Region of Delhi.

The present Indian economic scenario is finally showing a northward movement for the demand in the commercial real estate sector. Consecutively, the higher demand for the office space will also influence the sale in the residential real estate sector too. According to a market research, the first quarter of 2011 experienced a 20% increase (almost 6 million sq ft) in the demand for office market all over every potential real estate sectors in the country in comparison to the same duration last year. Almost around 27% of the total office space was absorbed in the National Capital Region of Delhi.

Market analysts opine that the Indian office market will carry on this growth graph in the coming years. With corporates reworking and introducing their expansion strategies nearly in all industry sectors, requirement levels and transaction rate are anticipated to continue the upbeat in the near to midterm. Although with momentous supply in the market, rentals are likely to stay under pressure except for Grade A office spaces in certain main micro-markets.

In spite of escalation in demand of office space, the rentals have not been raised as the market is viewing a good supply of quality office space in the area. This is actually a good news for the end user who is seeking for office space. The report further explains that as the demand levels have seen a rise but due to the high supply pipeline and ready availability of quality office space the prices have not experienced any undue increase. In a few micro-markets, elevated vacancy levels can lead to the development of some downhill pressure on values in the short to medium term. However, the values in the Central Business District (CBD) locations in cities like Delhi, Pune, Kolkata and Hyderabad continued to be constant where as cities like Bangalore and Chennai experienced development. The report also states that the office market in the country is likely to go on with the growth process with new opportunities coming in due to corporate expansion strategies.

The CBD of Connaught Place and surrounding locations in Delhi experienced improved attention from potential tenants in the first quarter of 2011. As compared to the earlier few quarters, there was no supply to the CBD in the first quarter. Analyzing the general shortage of new supply, a few Grade B buildings have started renovation plans in order to improve their amenities and get more tenants.

The CBD of Connaught Place and surrounding locations in Delhi experienced improved attention from potential tenants in the first quarter of 2011. As compared to the earlier few quarters, there was no supply to the CBD in the first quarter. Analyzing the general shortage of new supply, a few Grade B buildings have started renovation plans in order to improve their amenities and get more tenants.

Gurgaon experienced an addition of around 0.85 million sq ft of new IT office space and about 0.47 million sq ft of non-IT office space. Transaction going ons kept on the higher side as compared to the other micro-markets with absorption confirmed at around 0.75 million sq ft in IT/ITeS and another 0.12 million sq ft in the non-IT sectors. Higher transaction activity and increasing tenant attention on SEZ developments paved way for the hike in the rental values by almost 7-8 %.

On the other hand Noida witnessed a lower office space leasing activity as compared to the previous quarter. A rising tenant focus in SEZ developments along the Noida-Greater Noida expressway is expected to enhance the transaction activity in the near term.

In Mumbai it is the Bandra Kurla Complex or BKC which is currently the “hotspot” for most corporates, MNCs and banks as compared to the rival commercial business districts of Lower Parel and Nariman Point-in the latter, lease rentals are currently between Rs 225 and Rs 250 a sq ft on an average. “Nariman Point buildings can only offer offices ranging between 500 sq ft and 3,000 sq ft but clients who want a floor space in excess of one lakh sq ft find it readily available in BKC,” they said.

In Mumbai Experts said that a decade ago. “Developers preferred to construct residential apartments due to quick sales at the under-construction stage. Eight of out of 10 files submitted to the BMC for approval were residential. But with growing businesses, there is going to be a demand for quality commercial premises in the Central Business areas,” they said.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

June 21, 2011 at 5:43 pm · Filed under Banks, Broker, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, lawyer, legal, Loans, Marketing, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Referal, Repatriation, Residential Property, Selling ·Tagged bank, emi, financial institution, home loan, Indian Properties, Indian Real Estate, interest rate

Banks are pursuing potential borrowers with their teaser interest rates and exclusive offers. The real estate scenario today is experiencing development of new projects all over the country and builders are engaged in pushing their completed projects at good prices.

Banks are pursuing potential borrowers with their teaser interest rates and exclusive offers. The real estate scenario today is experiencing development of new projects all over the country and builders are engaged in pushing their completed projects at good prices.

BORROWING CORRECT AMOUNT

In the current economic scenario, most of the people who are buying homes are young, salaried IT employees, professionals, entrepreneurs and self-employed businessmen. Real estate has always been considered as lucrative and prudent investment option. The present generation has bought down the age of purchasing homes. The average age now is 28 -34.It is not like 20 years ago when most of the home buyers belonged to the age group of late 40s, who used all their savings to purchase a property. Today, the times have changed, the young generation is well traveled and more dynamic , and they are also being helped by the different financial institutions that have made home loans a far easier process than in the olden days.

The important thing to remember for taking a loan is not to extend the finances beyond a certain limit . The real estate market has product for every pocket i.e from economic affordable housing to ultra luxurious lifestyle condominiums and bungalows. The thing to remember is A bigger amount of home loan means that the borrower will have to pay higher amount as EMIs.

The banks are ready to give home loans of about 50% to 55% of the borrower total monthly take home salary after doing their own due diligence of the clients credit worthiness. Individuals of today are intelligent enough to understand their monthly expenses of their household. Market experience shows that not more than 30% -35% of your monthly income ( whether individual or combined) should form part of your EMI. As you move along in life various other needs keep cropping up like education and upbringing of children , medical expenses etc plus the inflation factor is always there.

STAY AWAY FROM DEBT CON

One needs to keep in mind also that when interest rates increase, the home loan borrowers who have opted for loan have to pay increase EMI installments. If one has not been prudent enough while taking a loan and has taken a bigger amount of loan then in some cases one has to make drastic changes in their day-to-day life and can even have to do away with their current lifestyle, luxuries, periodic investments and saving for emergencies. As mentioned above The amount given by the banks or the financial institutions as home loan results in an EMI and if EMI becomes more than 40 % of the borrower’s total monthly take home salary. The thumb rule suggests that it becomes hard for the home loan borrower to pay back to the financial institution. When borrowers are not able to pay back their EMIs, they end up taking some more loans to repay their previous loan. This taking of more loan to repay the previous loans is not advisale as it might drag a borrower into a vicious circle of debt trap

So the mantra which really everybody of today generation knows is to borrow right and tight. In today’s market scenario there are home options for every pocket.

And yes do remember “OLD is GOLD”, so do not hesitate to take advice of your elders and well wishers,. You will not loose anything, on the contrary will only gain from their experience.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

June 20, 2011 at 5:37 pm · Filed under Agent, Builder, Finance, Growth Investing, India Real Estate, Indian Properties, Indian Real Estate, Investing, legal, Loans, Pre-owned homes, Properties, Prospecting, Real esate, Real estate trends, Reality Firms, Referal, Repatriation, Residential Property, Selling ·Tagged apartment, business park, home loan, Indian Real Estate, investment, leasing, mall, plot, property location, residential property, tenant

Since the day you start earning you want to buy or invest in a property that suits your requirements. By the time this dream starts turning into realty, and finally you start searching for a property, two major factors determines your search. You either buy to invest or you buy to live. Then some other questions that arise are whether an apartment or a plot, Housing project by a developer or an independent house or plot in an already established locality. In order to get the best deal, you should have a clear picture in your mind as to what you are looking for, and the kind of property you are searching, you are the best judge of your situation.

Since the day you start earning you want to buy or invest in a property that suits your requirements. By the time this dream starts turning into realty, and finally you start searching for a property, two major factors determines your search. You either buy to invest or you buy to live. Then some other questions that arise are whether an apartment or a plot, Housing project by a developer or an independent house or plot in an already established locality. In order to get the best deal, you should have a clear picture in your mind as to what you are looking for, and the kind of property you are searching, you are the best judge of your situation.

Will you rent out the property and use the rent amount to pay your EMIs, or would you be able to pay back your home loan installments while you reside in your newly bought home. If you are looking forward to purchase an apartment, or a plot, then you need to plan about how you will handle your finances and continue your current lifestyle.

The property location will influence both the kind of tenants you will get and the type of returns on investment you will be acquiring. Areas that have higher employment opportunities are likely to get more tenants. So you should always check the property location for current or projected parks, malls, movie theatres, public transport hubs like the Metro and all the other factors that can help you to get more buyers or tenants.

DEVELOPMENT PROSPECT

Gather all details about any new project that is being developed or has been zoned into the locality in which you are eyeing a project. If there are a quiet few new business parks or malls coming up in location near your property then it is possibly a good growth neighborhood.

LEASING OUT

When you are purchasing an apartment, do check the list of amenities offered by the developer within the premises, property location and quality of construction work. Prospective tenants these days are looking for well furnished apartment with wardrobes, utilities in the kitchen and bathroom furnishings, so ensure that your apartment has all these facilities in place. Also keep a record of all required lease documents duly signed by the tenant and you in order so that every formality can be completed as early as possible.

Join atOnePlace as a Agent. Be an associate and increase your business

Latest Residential Deals on Indian Property

Free Legal Advice for Indian Real Estate

Permalink

One always thinks that owning a home is the best option. But at times renting has an upper hand as it can economically help you and help you save on your cash. It is you who can see through the situation and then work out a plan that suits you and your pocket before you decide anything.

One always thinks that owning a home is the best option. But at times renting has an upper hand as it can economically help you and help you save on your cash. It is you who can see through the situation and then work out a plan that suits you and your pocket before you decide anything.