The real estate sector in India is on a rapid growth trajectory. The Indian real estate industry is expected to reach a size of US$ 180 billion by 2020. India leads the pack of top real estate investment markets in Asia for 2010, according to a study by Urban Land Institute, a global non-profit education and research institute, released in December 2009. The report, which provides an outlook on Asia-Pacific real estate investment and development trends, points out that India, in particular Mumbai and Delhi, are good real estate investment destinations. Residential properties are viewed as more promising than other sectors. While, Mumbai, Delhi and Bengaluru top the pack in the hotel ‘buy’ prospects as well.

Further, real estate companies are coming up with various residential and commercial projects to fulfill the demand for residential and office properties in Tier-II and Tier-III cities.

Latest policy of government of India regarding investment in property by NRI’s/PIO is as follows:

Acquisition and Transfer of Immovable Property in India

1) A person resident outside India who is a citizen of India (NRI) can acquire by way of purchase, any immovable property in India other than agricultural land / plantation property/ farm house. He can transfer any immovable property other than agricultural or plantation property or farm house to:

i. A person resident outside India who is a citizen of India, or

ii. A person of Indian origin resident outside India, or

iii. A person resident in India.

2) He may transfer agricultural land / plantation property / farm house acquired by way of inheritance, only to Indian citizens permanently residing in India.

3) Payment for acquisition of property can be made out of:

i. Funds received in India through normal banking channels by way of inward remittance from any place outside India, or

ii. Funds held in any non-resident account maintained in accordance with the provisions of the Foreign Exchange Management Act, 1999 and the regulations made by Reserve Bank from time to time.

4) Such payment cannot be made either by traveller’s cheque or by foreign currency notes or by other mode other than those specifically mentioned above.

5) A person resident outside India who is a person of Indian Origin (PIO14) can acquire any immovable property in India other than agricultural land / farm house / plantation property:

i) By way of purchase out of funds received by inward remittance through normal banking channels or by debit to his NRE / FCNR(B) / NRO account.

ii) Such payments cannot be made either by traveller’s cheque or by foreign currency notes or by other mode other than those specifically mentioned above.

iii) By way of gift from a person resident in India or a NRI or a PIO.

6) A PIO may acquire any immovable property in India by way of inheritance from a person resident in India or a person resident outside India who had acquired such property in accordance with the provisions of the foreign exchange law in force or FEMA regulations at the time of acquisition of the property.

7) A PIO may transfer agricultural land / plantation property / farmhouse in India acquired by way of inheritance, by way of sale or gift to person resident in India who is a citizen of India.

8 ) A PIO may transfer any immovable property other than agricultural land / Plantation property / farmhouse in India:

i. By way of sale to a person resident in India.

ii. By way of gift to a person resident in India or a Non-Resident Indian or a PIO.

Repatriation of sale proceeds

(i) In the event of sale of immovable property other than agricultural land / farm house / plantation property in India by NRI / PIO, the authorised dealer will allow repatriation of sale proceeds outside India provided:

a) the immovable property was acquired by the seller in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of FEMA Regulations;

b) the amount to be repatriated does not exceed (a) the amount paid for acquisition of the immovable property in foreign exchange received through normal banking channels or out of funds held in Foreign Currency Non-Resident Account or (b) the foreign currency equivalent as on the date of payment, of the amount paid where such payment was made from the funds held in Non-Resident (External) Rupee Account for acquisition of the property; and

c) In the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties.

(ii) In the case of sale of immovable property purchased out of Rupee funds, AD Category – I banks may allow the facility of repatriation of funds out of balances held by NRIs / PIO in their Non-Resident Rupee (NRO) accounts up to USD 1 million per financial year, subject to production of undertaking by the remitter and a certificate from the Chartered Accountant in the formats prescribed by the CBDT.

Refund of application/earnest money/purchase consideration

Authorize dealer may permit repatriation of amounts representing the refund of application/earnest money/purchase consideration made by house building agencies/seller on account of non allotment of flat/plot/cancellation of booking/deals for purchase of residential/commercial property, together with interest, if any (net of income tax thereon), provided the original payment was made out of NRE/FCNR account of the account holder, or remittance from outside India through normal banking channels and the authorized dealer is satisfied about the genuineness of the transaction. Such funds may also be credited to the NRE/FCNR account of the NRI’s/PIO, if they so desire.

Remittances of sale proceeds of residential accommodation purchased by NRIs / PIO out funds raised by them by way of loans

Authorized dealers may allow repatriation of sale proceeds of residential accommodation purchased by NRIs/PIO out of funds raised by them by way of loans from the authorized dealers/housing finance institution to the extent of such loan/s repaid by them out of foreign inward remittances received through normal banking channel or by debit to their NRE/FCNR accounts.

Remittances of sale proceeds of the immovable property acquired out of Rupee funds – Lock-in-Period removed

The existing FEMA regulations permit Non-Resident Indians (NRIs) and persons of Indian Origin (PIO) to remit up to USD one million per financial year (April-March) for any bonafide purpose out of the balances in their Non-Resident Ordinary (NRO) accounts. The balance in the NRO accounts may also include the sale proceeds of immoveable property acquired by the non-resident out of his/her resources in India, or sale proceeds of property received by way of inheritance or gift.

Mukesh Goel

Partner Mukesh Raj & Co.

mukesh@mukeshraj.com

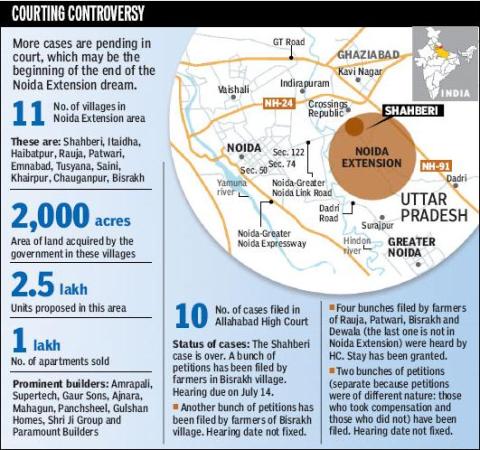

On 19th July 2011 another verdict was given by the Allahabad High Court that scraped another land acquisition in Noida Extension by the Greater Noida Industrial Authority. 589 hectares of land was acquired by the Authority in Patwari village, in Noida Extension, by bringing into play the urgency clause. The land was purchased for the industrial development in the region but it was given away to real estate developers for numerous residential and commercial projects.

On 19th July 2011 another verdict was given by the Allahabad High Court that scraped another land acquisition in Noida Extension by the Greater Noida Industrial Authority. 589 hectares of land was acquired by the Authority in Patwari village, in Noida Extension, by bringing into play the urgency clause. The land was purchased for the industrial development in the region but it was given away to real estate developers for numerous residential and commercial projects.